For businesses, it is the quality of revenues and earnings that matter.

“Quality is more important than quantity. One home run is much better than two doubles.”

— Steve Jobs

TL;DR

- Multiples (of revenue, EBITDA or earnings) are a simplified method for valuing businesses.

- Multiples of apparently similar businesses (e.g. selling comparable products with identical business models) can vary quite widely.

- The ‘quality’ of revenues and earnings is a meaningful influence on the variation between multiples of apparently similar businesses.

- There are three big drivers of quality—predictability, organic growth, and capital efficiency.

- The Strategic CFO works with the entire leadership team to make the necessary investments that improve the markers of quality.

Principles of Valuation

A core question in long-term investing is: “What is the ‘right’ value for this business?”

A foundational principle of corporate finance is that the value today of any business (or income generating asset) is the sum of its discounted future cash flows. It follows from this principle that one should be willing to buy an asset in exchange for the expected future dividends if, when adjusted for the time value of money and risk of the business, these cash flows will be higher than the cost today.

Often we also triangulate on the fair value of an asset by comparing it on the basis of a common size ratio to the value of other similar assets. For homes, that common size ratio is usually price per square foot. For business, it is often a multiple of revenue or some adjusted earnings metric. This multiple is a shorthand for our expectations of the likely future revenues, earnings and thus cash flows.

Variation Amongst Multiples

A common question that arises is: ‘Why do multiples vary so widely amongst apparently similar assets?’

For example, why is Tesla assigned a much higher multiple than GM or Toyota? After all, these three businesses are all automobile manufacturers.

In the SaaS universe, why do Atlassian and Datadog trade at a much higher multiple than Shopify and Workday? All three have many similarities in their business model.

The Two Parts of Business Value

Business value consists of the sum of two parts.

- Part I: The value of the current business model (what exists today and future growth potential within existing and closely adjacent markets).

- Part II: The option value of new business models or future operations that could be built by this business/team in new markets.

This post will focus on Part I. To be clear, the option value of future business models can be very important in overall valuation. Innovative companies with track-records of entering news industries or building brand new products/services such as Amazon and Apple benefit meaningfully from Part II.

Quality of Revenue and Earnings Matter

I will walk through components that influence the ‘quality’ of revenue and earnings and thus influence the valuation of the ‘current business model.’

There are three primary components to consider in evaluating quality — predictability, organic growth, and capital efficiency.

(For the rest of this post I will refer to the quality of revenue and earnings by the shorthand of ‘QoE’.)

The Simplest Version of QoE: Accounting QoE

This first cut at QoE is what I refer to as the ‘accounting QoE.’

Accounting QoE is an analysis presented by the Seller (or their advisors) when a company is being sold or raising capital. It ‘normalizes’ historical earnings by excluding any non-recurring one-times or extraordinary charges. These items might include: (i) severance payments; (ii) restructuring costs; (iii) transaction costs — legal fees, banker fees etc.; (iv) payments to prior owners (e.g. VC or PE) to ‘monitor’ the business, and, (v) any other non-recurring expenses that should not exist post sale.

The buyer often hires an accounting or consulting firm to investigate the books and records of the seller to determine if these adjustments are appropriate and accurately reflect the ongoing performance of the company.

Then, if debt is being raised to finance the investment, the buyer will use this ‘Adjusted Earnings’ metric to pitch the lenders on how large the debt facility should be (which is often determined as a multiple of adjusted earnings).

Diving Deeper into QoE

In reality, valuation multiples are impacted by many other factors beyond these accounting QoE adjustments described above.

So let’s dive deeper in the additional items that impact the quality of revenue and earnings and hence influence the multiples assigned to businesses.

Predictability

Merriam-Webster defines predictable as ‘able to be known, seen, or declared in advance.’

Predictability matters because valuation is about expected future cash flows. When a business is predictable the confidence interval around the likely future cash flows increases. Higher confidence leads to lowering the risk (discount rate) by which these cash flows are discounted. That in turn increases the valuation multiple.

Subscription business models or others where the customer acts in a similar manner to a subscription are considered to have higher predictability. An example of the latter would include dog food. Once pet owners find a brand they like, they tend to purchase the same brand on a regular basis because dogs tend to get their digestive tract accustomed to a food type and generally don’t skip meals or eat out.

Within subscription businesses determinants of predictability include:

- Contract Term Length. These can be monthly, annual or multi-year. Longer term lengths are considered more predictable. Behaviorally, when a customer selects a longer-term contract they are signaling that they value the product or service more and intend to use it over the long-term. It is why businesses will offer discounts (often significant) to customers who purchase longer contract lengths.

- Customer Retention Rate. This metric measures the % of customers who renew their contract when it expires (whether each month or each year). Retention is an indicator of the ‘stickiness’ of a product/service and the switching costs. One of the competitive moats companies can build is a high switching cost (i.e. by being a meeting place like LinkedIn or a data storage hub such as Salesforce where leaving would result in a sizable loss of benefits for the customer.)When a customer renews they do not need to be replaced with a newly acquired customer. The business saves on marketing, sales and onboarding spend. High retention rates indicate the product is providing customers with long-term value which in turn increases the multiple assigned to such business.

- Customer Concentration. Customer concentration (e.g. 5 customers representing 80% of the revenue of a business) increases risk in multiple ways. Any one large customer canceling or going out of business will dramatically reduce revenues. And, large customers have greater negotiating power to get better terms (lower rates, slower payment etc.) Thus customer concentration reduces the predictability of a subscription and negatively impacts valuation multiples.Twilio, when it went public, had to disclose in its S-1 filing its reliance on Uber who contributed over 20% of its revenue in 2015, over 10% in 2015, and over 10% in the first half of 2016. A more recent example of the danger of customer concentration is Fastly. Its stock fell over 30% after its earnings release in mid October 2020 when it revealed that Bytedance (Tik Tok owner) who accounted for ~12% of their revenues planned to lower its spending on their platform.

Growth

Growth is about the future. A perspective on growth potential aims to answer the question: “How much larger can this business be in the years to come?”

Growth can be either high quality or low quality. The quality of growth is determined by how much the ‘pays’ for growth. Paying can take the form of discounts, rebates, below market financing, or paid advertising.

Organic growth, a metric that tells you how much a business will grow without the addition of new customers, is one measure of the quality or efficiency of growth. The level of organic growth is impacted by several factors including:

- Volume / Usage Growth. This happens when existing businesses consume more of the same product or service. Usage based business models (such as Snowflake or Datadog) benefit directly from increased usage by individual users without the need for ‘seat’ growth. Other businesses, such as Salesforce (and most traditional SaaS companies) grow with seat license increases (often tied to company headcount). In both these growth cases, the business does not need to start a new, costly and time-consuming sales cycle to increase revenues.

- Cross-Selling Additional Products. Businesses also grow efficiently by cross-selling additional products to the same customer. Typically these are related products that are naturally related to the first product (e.g. new modules in software to provide additional valued functionality) or natural bundles (e.g. whether coffee + a donut, TV + internet, or soda + chips.) Once a customer is buying multiple products from a business, the risk of canceling tends to fall, further improving retention rates.

- Pricing Power. Can the business raise pricing without causing customers to downgrade the level of service (i.e. buy less) or cancel altogether? The ability to raise prices is related to how essential the service is to customers, what alternatives exist, and how hard it is to switch (what data or functionality might be lost as well as how challenging it would be for everyone who uses the service to learn a new product).

A price increase is the most profitable type of growth. Not surprisingly businesses that have the ability to raise prices over time receive a premium valuation multiple.Let’s compare Netflix and Quickbooks with regard to pricing power. Netflix has reached a point in the penetration of households where its ability to raise prices without having a lot of customers cancel is low. Hence the reason it is launching a lower priced, advertising supported tier in 2023. Quickbooks by comparison is still viewed as relatively inexpensive by all the businesses that use it, a core product, and a pain to replace. Not surprisingly, Quickbooks was able to raise prices by about 10% in mid 2022 without a lot of customer loss.

A second measure of the quality of growth is answering the question as to whether growth is secular or cyclical. Sometimes a short-term expansion in the growth rate is misunderstood to be permanent. And when reality strikes (as it has in the second half of 2022 into early 2023) with growth returning to its longer-term average rates, valuation multiples can shrink significantly.

- Secular. Secular, in the context of business growth, implies a long-term or indefinite duration. (Obviously nothing can grow at a huge rate forever, and mathematically the growth rate of a business has to converge towards the rate of the economy they are operating in.)

Nonetheless, secular growth trends are often one pillar in venture and growth capital investment hypotheses. For example, the transition from internal combustion engines to electric or hydrogen or other cleaner burning technology is a secular trend. Tesla’s valuation multiple benefits from it being at the center of this secular trend whereas GM and Toyota need to replace profitable, legacy internal combustion engine sales and are not purely tied to the secular tailwind. - Cyclical Growth. Companies with cyclical growth can be very profitable during certain periods. Take the example of all the integrated oil companies (e.g. ExxonMobil, Chevron etc.) These businesses are reporting record earnings in 2022 and into early 2023 due to the recent high oil prices coupled with their lower capital spending in new exploration. Yet, few investors believe these trends are permanent. Hence their high revenues and record earnings receive a low multiple.

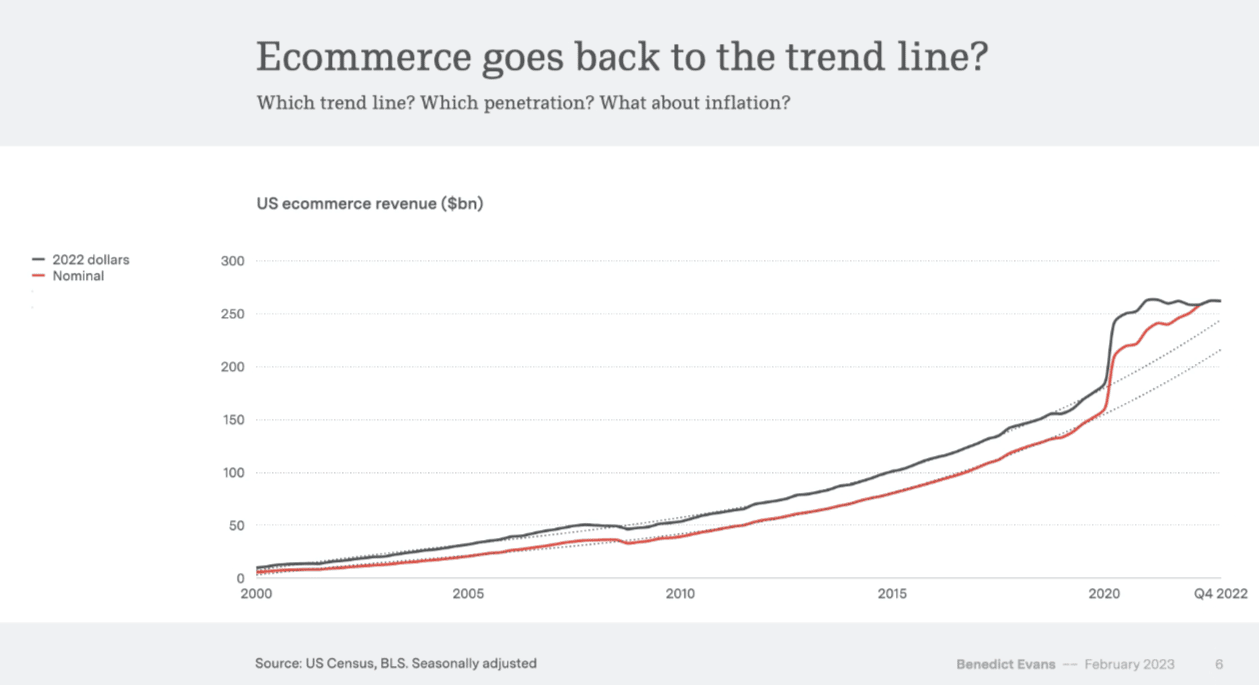

- Over-Earning and Regression to the Mean. The impact of COVID lockdowns on digital consumption (e.g. e-commerce vs. shopping in person, and exercise at home with a connected device vs. going to the gym) offers a recent example of mistaken extrapolation. Many CEOs and investors mistook a temporary change in the secular growth trend line for a permanent one. When the investment community realized they had made this mistake, valuation multiples came down markedly. A look at the stock price charts of Peloton, Shopify and Zoom would illustrate this.

The graph below illustrates how while e-commerce continues to grow at a steady pace, what seemed like a huge uptick in growth in 2020 was a temporary increase followed by a regression to the mean.

Capital Efficiency

Capital efficient businesses are able to accomplish more with less investment.

- Marginal Profitability. Atlassian and Datadog trade at high multiples of revenue in part because they convert each dollar of revenue into a higher amount of gross profit and free cash flow than Shopify or Workday. Their gross margins are both ~80% (Atlassian’s is higher) vs. 50% for Shopify and 72% for Workday. And they spend less on sales and marketing than Workday.For software or similar businesses with low capital spending, I focus on a metric called CAC Payback months (adjusted for gross margin) as my measure of marginal profitability. I much prefer this metric to the LTV to CAC ratio which still seems to be the preferred metric of most investors.

- Capital Intensity. While we haven’t discussed in detail the important differences between earnings or EBITDA and free cash flow, it is a critical one for valuation. Dividends or other payouts to shareholders can only be made after the necessary re-investment in the business. Some of this re-investment is called capital expenditures.

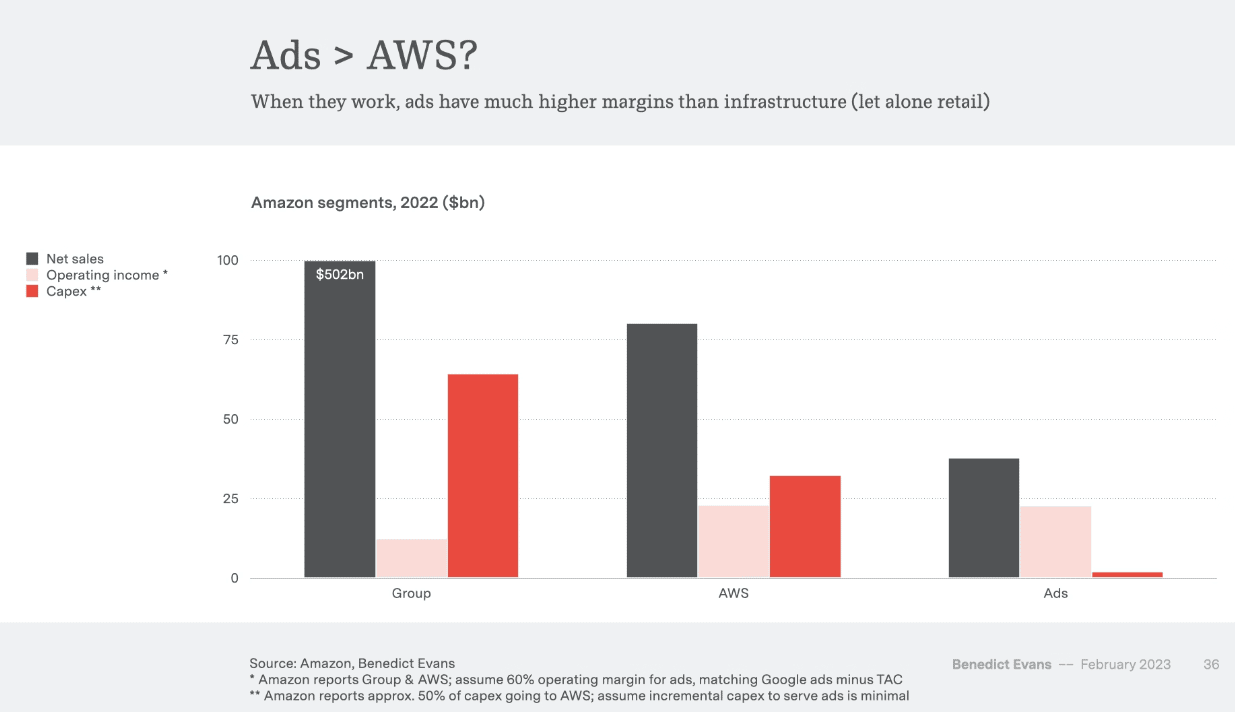

The fascinating chart below (courtesy Benedict Evans who does great annual presentations on media and retail) makes a case that the incredibly capital efficient and growing advertising business of Amazon may well be worth more than the much larger AWS segment. The latter incurs a lot of capital spending or reinvestment into the business. For businesses that have low capital spending, the payment frequency and payment terms related to invoices can be very important. Collecting from customers for a 1-year or multi-year contract in advance allows the business to finance a lot of growth from customer payments. That means the business does not need to dilute shareholders by raising additional equity or take on additional risk by borrowing from lenders.

For businesses that have low capital spending, the payment frequency and payment terms related to invoices can be very important. Collecting from customers for a 1-year or multi-year contract in advance allows the business to finance a lot of growth from customer payments. That means the business does not need to dilute shareholders by raising additional equity or take on additional risk by borrowing from lenders.

Capital efficient businesses are rewarded with higher multiples as shareholders are less concerned with future dilution. In SaaS, the burn multiple metric aims to measure the capital efficiency of investing in growth.

The Strategic CFO Works to Improve these Markers of Quality

One element of the Strategic CFO role is to think about the longer-term. Specifically how will the next investor who considers buying this business evaluate it.

It involves putting oneself in the shoes of the other. The next buyer will naturally be skeptical and be looking for warts and other signs of deeper problems. The strategic CFO must then work across departments with other leaders to not only cover up blemishes (those will be easily discovered) but actually strengthen the foundation and bones of the business.

This involves a steady and consistent investment in improving quality metrics that influence valuation. In this way, when that future buyer and their advisors dive deep during the diligence process and shine a microscope on the business they mostly see the strong systems, process and underlying infrastructure.